Navigating Business Risks with Bagley Risk Management

Navigating Business Risks with Bagley Risk Management

Blog Article

How Livestock Risk Defense (LRP) Insurance Coverage Can Secure Your Animals Investment

Livestock Danger Protection (LRP) insurance stands as a trusted shield against the uncertain nature of the market, offering a critical method to protecting your assets. By delving into the intricacies of LRP insurance and its multifaceted benefits, livestock manufacturers can strengthen their financial investments with a layer of protection that transcends market fluctuations.

Recognizing Livestock Risk Protection (LRP) Insurance

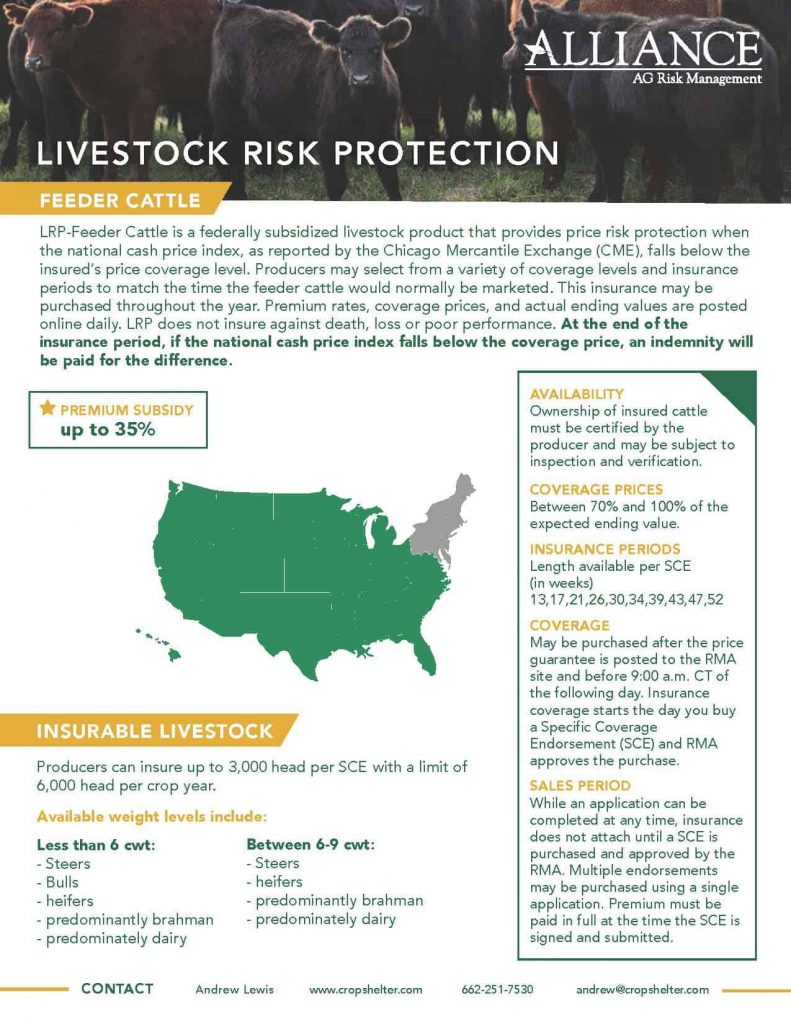

Understanding Animals Threat Protection (LRP) Insurance coverage is essential for animals producers wanting to reduce economic threats connected with price variations. LRP is a government subsidized insurance policy product made to protect producers versus a decrease in market value. By giving insurance coverage for market rate declines, LRP aids manufacturers secure a flooring price for their animals, guaranteeing a minimal degree of earnings despite market variations.

One trick facet of LRP is its versatility, enabling producers to customize insurance coverage levels and policy sizes to fit their particular needs. Manufacturers can select the number of head, weight array, insurance coverage rate, and insurance coverage period that align with their production objectives and risk tolerance. Comprehending these adjustable choices is vital for producers to successfully handle their cost danger direct exposure.

Moreover, LRP is offered for different animals kinds, including cattle, swine, and lamb, making it a functional risk monitoring device for livestock producers throughout different industries. Bagley Risk Management. By acquainting themselves with the details of LRP, producers can make educated decisions to safeguard their financial investments and make certain monetary security despite market uncertainties

Benefits of LRP Insurance for Livestock Producers

Animals manufacturers leveraging Livestock Danger Security (LRP) Insurance policy acquire a calculated advantage in protecting their financial investments from cost volatility and securing a stable economic ground amidst market unpredictabilities. One vital advantage of LRP Insurance coverage is cost security. By establishing a flooring on the rate of their livestock, manufacturers can mitigate the risk of considerable monetary losses in case of market slumps. This permits them to plan their spending plans better and make notified decisions concerning their procedures without the consistent fear of price changes.

Additionally, LRP Insurance policy supplies manufacturers with assurance. Understanding that their financial investments are protected versus unforeseen market changes permits manufacturers to concentrate on various other aspects of their organization, such as improving pet health and wellness and well-being or maximizing manufacturing processes. This satisfaction can cause enhanced performance and profitability over time, as producers can operate with even more confidence and stability. On the whole, the benefits of LRP Insurance policy for livestock manufacturers are considerable, offering a useful device for managing threat and making sure financial protection in an unpredictable market environment.

Exactly How LRP Insurance Coverage Mitigates Market Risks

Minimizing market dangers, Livestock Danger Protection (LRP) Insurance coverage provides animals manufacturers with a reputable guard versus price volatility and financial unpredictabilities. By supplying security versus unanticipated cost drops, LRP Insurance coverage aids producers protect their financial investments and keep monetary security when faced with market fluctuations. This kind of insurance permits animals producers to secure a rate for their animals at the beginning of the policy period, making certain a minimal price degree regardless of market adjustments.

Actions to Secure Your Livestock Financial Investment With LRP

In the world of farming threat management, carrying out Livestock Risk Protection (LRP) Insurance coverage includes a critical procedure to guard investments against market variations and uncertainties. To secure your animals financial investment efficiently with LRP, the initial step is to analyze the specific threats your procedure faces, such as cost volatility or unforeseen weather condition events. Recognizing these risks enables you to establish the protection level needed to secure your investment properly. Next off, it is vital to study and choose a credible insurance copyright that provides LRP policies customized to your animals and organization needs. As soon as you have actually chosen a company, thoroughly assess the plan terms, conditions, and coverage limitations to ensure they straighten with your risk administration goals. click here to read In addition, on a regular basis keeping track of market patterns and adjusting your protection as needed can aid maximize your defense against prospective losses. By complying with these actions faithfully, you can boost the safety of your livestock investment and navigate market uncertainties with self-confidence.

Long-Term Financial Safety And Security With LRP Insurance

Making sure enduring economic stability through the use of Animals Threat Defense (LRP) Insurance policy is a sensible lasting method for agricultural producers. By incorporating LRP Insurance into their risk management strategies, farmers can guard their animals financial investments versus unanticipated market variations and negative events that might jeopardize their financial health with time.

One secret benefit of LRP Insurance for lasting monetary security is the comfort it supplies. With a reputable insurance plan in position, farmers can reduce the financial threats connected with unstable market conditions and unanticipated losses because of factors such as illness episodes or all-natural calamities - Bagley Risk Management. This stability look at here permits producers to concentrate on the daily procedures of their livestock organization without continuous bother with possible monetary problems

Additionally, LRP Insurance policy offers an organized method to taking care of danger over the lengthy term. By setting certain insurance coverage levels and picking suitable recommendation periods, farmers can customize their insurance plans to line up with their financial objectives and risk tolerance, guaranteeing a lasting and secure future for their animals procedures. In conclusion, buying LRP Insurance policy is a proactive technique for farming manufacturers to achieve enduring economic security and safeguard their resources.

Conclusion

To conclude, Livestock Danger Protection (LRP) Insurance coverage is a beneficial device for animals manufacturers to mitigate market risks and secure their financial investments. By understanding the benefits of LRP insurance coverage and taking actions to apply it, manufacturers can attain lasting economic security for their operations. LRP insurance offers a security web versus cost variations and ensures a level of security in an uncertain market setting. It is a sensible selection for safeguarding animals financial investments.

Report this page